July 2024 at a glance

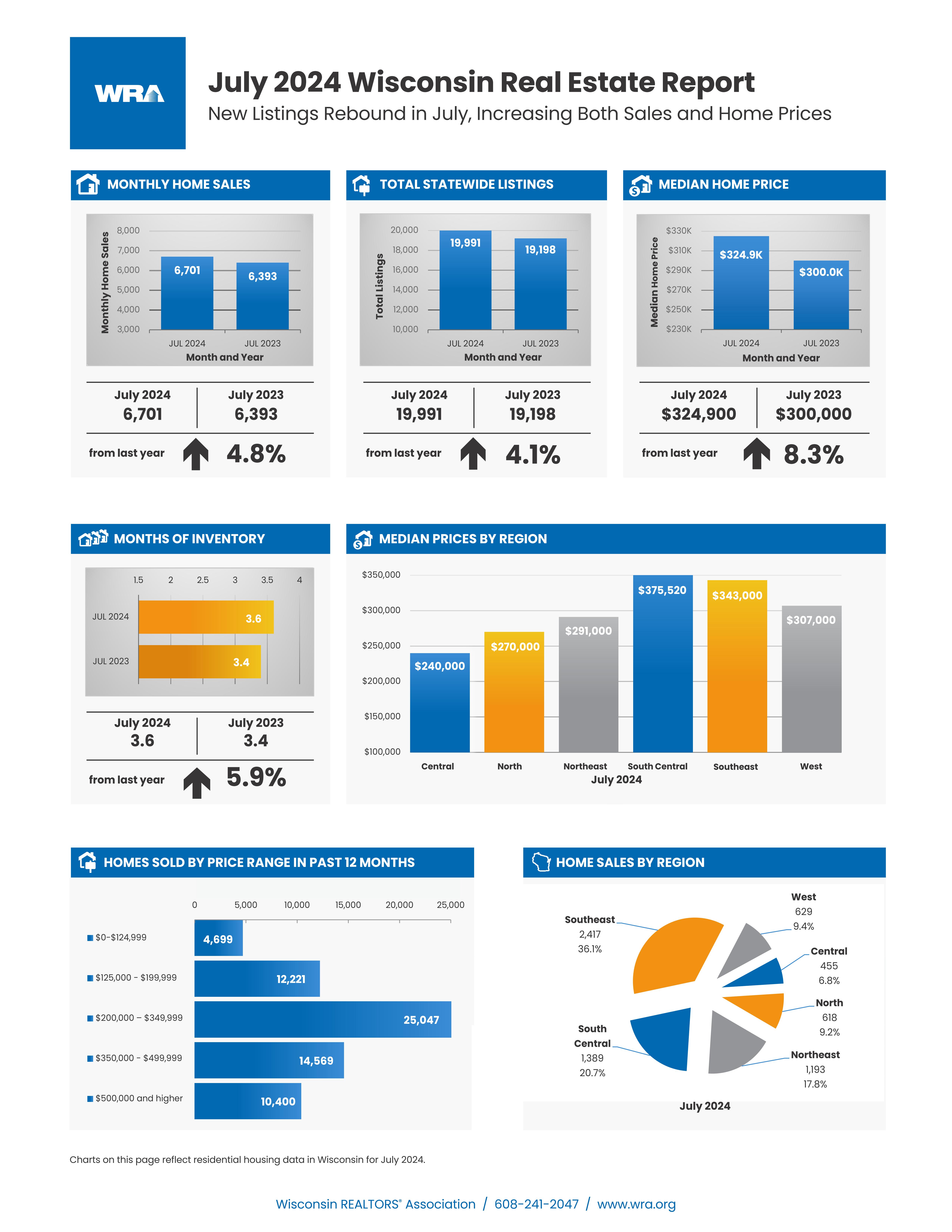

- New listings bounced back in July after an unexpected decline in June listings and home sales. July’s bounce back helped grow existing home sales statewide. Specifically, new listings rose 2.7% over the past 12 months, which led to 4.8% growth in sales over that same period. This pushed the median price up to $324,900, which is an 8.3% increase compared to July 2023.

- On a year-to-date basis, both sales and prices rose 7% compared to the first seven months of 2023. Total sales increased to 37,334 closed homes, and the median price rose to $305,000.

- Every region saw year-to-date sales grow, with growth in the range of 10% to 12.6% in the North, Northeast and Central regions. Growth ranged between 6.1% and 7.3% in the West and South Central regions, and growth was moderate at 3.8% in the Southeast region. Year-to-date median price increases were more consistent across the regions, rising between 6.5% and 8.9% compared to the first seven months of 2023.

- For the second straight month, the 30-year fixed-rate mortgage improved. After rising to an average of 7.06% in May, it fell to 6.92% in June and 6.85% in July. This puts the July 2024 rate just one basis point above its level in July 2023.

- Weak inventory continues to show a strong seller’s advantage statewide with just 3.6 months of supply, which is well below the six-month benchmark signaling a balanced market. Homes at lower price points below $350,000 had less than 3 months of supply. Inventory was higher for homes selling in the $350,000 to $499,999 price points at 4.1 months, and those $500,000 and higher have enough supply to be considered balanced.

Additional analysis

New Listings Rebound in July

"It was good to see new listings rebound in July after falling unexpectedly in June. Even though our inventory growth has been modest, it is vital if we are to achieve sustained growth in existing home sales.”

Mary Jo Bowe, 2024 Chair of the Board of Directors, Wisconsin REALTORS® Association

Affordability Remains Low but Some Reason for Optimism

"Rising home prices and higher mortgage rates are primary reasons that affordability has suffered the last couple of years. The recent increase in new listings has led to a slight moderation in our price appreciation over the last year, and although mortgage rates have remained stubbornly high, we’ve seen the 30-year fixed mortgage rate fall for a second straight month. Hopefully these trends continue and lead to improved affordability."

Tom Larson, President & CEO, Wisconsin REALTORS® Association

More Signals of Moderating Inflation

"The Fed’s preferred indicator of inflation is core inflation measured using a broad index of prices called the Personal Consumption Expenditure (PCE) index. The May and June PCE annualized inflation rates came in at just 2.6%. While this is still above the Fed’s target rate of 2%, it has improved significantly over the last year. Given the weak job growth in July, the prospect of one or more short-term rate cuts has likely increased."

Dave Clark, Professor Emeritus of Economics and WRA Consultant